8 year mortgage rates explained for smart homebuyers

What makes them different

An 8-year mortgage compresses repayment into a focused timeline, often pairing a lower rate with higher monthly payments. Total interest can drop sharply versus longer terms. If you’re refinancing or eager to be debt-free sooner, this in-between option can fit neatly.

When an 8-year term fits

It shines when income is steady, equity is strong, or you want the house paid off before college or retirement. It can turn a refinance into real savings without committing to 15 or 30 years.

- Faster equity: Principal falls quickly.

- Less interest: Shorter term, lower cost.

- Clear goals: Align payoff to milestones.

- Predictability: Fixed payment cadence.

- Refi-friendly: Short reset without 30 years.

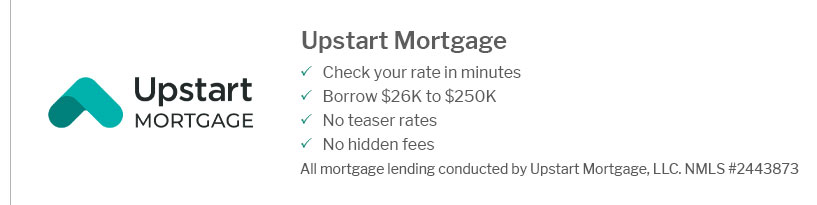

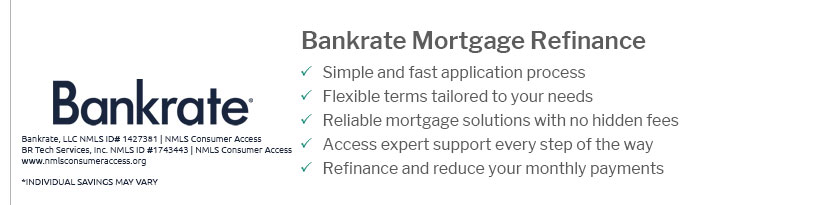

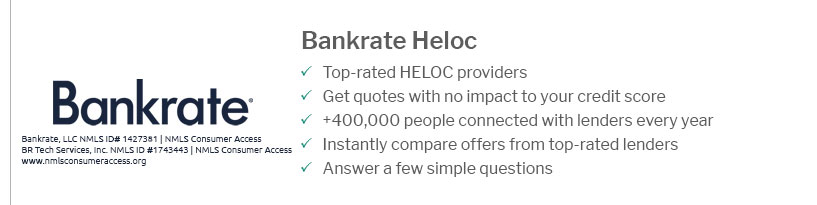

How to compare offers

Weigh APR, points, and total fees-not just the headline rate. Gather same-day quotes, ask about locks, and calculate break-even on closing costs. If cash flow’s tight, biweekly payments can mimic an 8-year pace on a slightly longer loan.